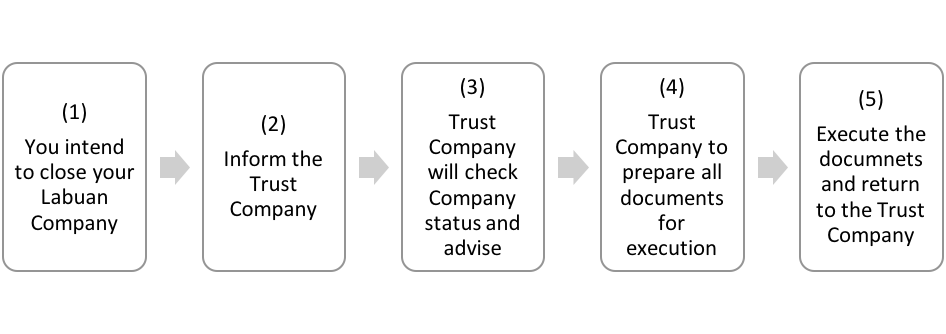

One of the most questions we received on top of “how to incorporate a Labuan company“ is “how close a Labuan company“

“How to close a Labuan company” is more of a simple layman terms which should be used as “how to dissolve a Labuan company“. There are two ways on how to dissolve a Labuan company:

1. Voluntary Winding Up Under Section 131A of the Labuan Companies Act 1990 (or more frequently known as Liquidation)

This is the best and preferred method to dissolve a Labuan Company. However it is the most expensive amongst the two methods.

For all Labuan companies intended to be dissolved by Voluntary Winding Up Under Section 131A of the Labuan Companies Act 1990, it is required to do the followings:

- Closure of personal tax file with LHDN, if any

- Close all company bank accounts

- Any surplus cash of the Labuan Company is to be distributed to its shareholders subject to the company Memorandum and Articles of Association. More-often it is distributed based on the shareholding percentage.

- Zerorised all Balance Sheet items include payment to all creditors and write off any bad debts (if any)

- Appointment of a Liquidator and prepay all liquidator fees

- Prepay all company secretary fee and invoices for assisting in the voluntary winding up.

- Prepay LFSA Fees in the voluntary winding up.

Labuan Company can apply to Labuan Financial Services Authority (LFSA) for the Declaration of Dissolution Notice accompany with the following documents:

- A statutory declaration by the Director

- A statutory declaration by the Shareholder

- A copy of the advertisements one in international financial newspaper such as the Financial Times or Wall Street Journal

- A copy of the advertisements and one in a local newspaper such as the Daily Express or Borneo Times

- A Tax Clearance notice from Lembaga Hasil Dalam Negeri (LHDN) that is has no objection to LFSA making a declaration of dissolution of the company.

- The Declaration of Dissolution intent notice were sent to all Directors

- The Declaration of Dissolution intent notice were sent to all Shareholders

- Fee of USD 2,000 (assuming the exchange rate of USD1.00 = Ringgit 4.00) or Ringgit 8,000 payable to LFSA.

- All fees including annual fee owed by the Labuan company to LFSA is to be paid prior of the approval of the Declaration of Dissolution Notice. The full annual fees of Ringgit 2,600 or USD 650 (assuming the exchange rate of USD1.00 = Ringgit 4.00) is payable

- Corporate Services Trust Company professional fee for this purpose will be USD 1,000 exclude Out of Pocket expenses. For more complicated case such as the company with very long history in business our professional fees will be higher in commensurate with the complexity and time cost.

- On top of our fee as stated above the liquidator fees is also payable. The liquidator fee in general is USD 3,000 exclude out of pocket expenses. For more complicated case such as the company with very long history in business our professional fees will be higher in commensurate with the complexity and time cost.

If there is no objection received from any party of the above, LFSA may approve the dissolution application less than 3 weeks after 30 days notice. The Declaration of Dissolution Notice publication issued by LFSA is valid for six (6) years. Any creditors claim or person to be interested may apply to Court within the validity date of 6 years to revoke the dissolution.

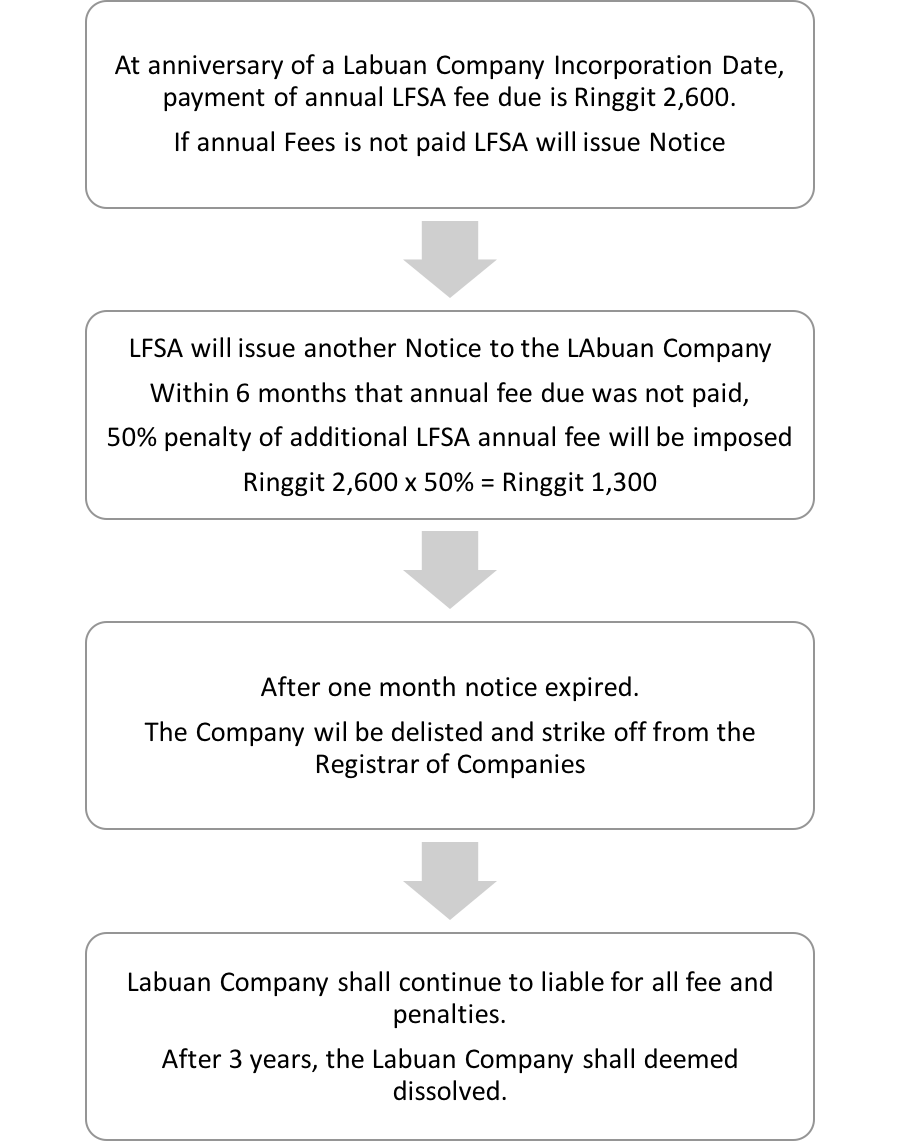

2. Default of Annual Fee Payment to LFSA under Section 151 of the Companies Act 1990

For all Labuan companies intended to be strike off or dissolution, it is advisable to comply the following:

- Close all bank accounts

- Any surplus cash of the Labuan Company is to be distributed to its shareholders subject to the company Memorandum and Articles of Association. More-often it is distributed based on the shareholding percentage.

- Zerorised all Balance Sheet items include payment to all creditors and write off any bad debts (if any)

- Prepay all company secretary fee and invoices for assisting in the strike off.

- Closure of corporate tax file with IRB corporate division (Labuan Company)

- Closure of personal tax file with LHDN

- All Labuan companies are required to pay LFSA annual fee of Ringgit 2,600 one month before anniversary date of the date of incorporation.

- If annual Fees for No.1 above is not paid LFSA will issue Notice

- The company that failed to pay LFSA annual fees of shall be imposed Penalty as follows :

- Late Payment for 1 to 3 months RM 100.00

- Late Payment for 4 to 6 months – MYR150.00

- Late Payment late for more than 6 months – MYR1,300.00 (which 50% of annual government fee)

- If the Labuan company still failed and did not pay the annual fee of RM 2,600 and the 50% of the penalty of RM 1,300 after one month from the date of expiration of six (6) months notice given, LFSA will send a written notice to Company Secretary to informed that the name of the Labuan Company shall be delisted and struck off from the LFSA Register of Companies

- The Labuan Company may appeal to Labuan FSA to extend the period subject to LFSA approval.

- Once the name has been struck off the register continuously for a period of 3 years, the Labuan Company is deemed to have dissolved. Once the company is struck off, the directors can apply to Inland Revenue to close the corporate tax file and all other tax files. During the process of striking off, Labuan Company is liable to compliance with yearly tax filing even when the company is dormant or inactive.

- Default Annual Fee Payment with Labuan FSA under Section 151 of The Labuan Companies Act 1990 is not applicable to a Labuan company in the process of being wound up and dissolved.

- Please note that after the Labuan Company has been struck off from the Register of Companies, the Labuan Company shall not carry on any business and shall remain liable for all claims, debts, liabilities and obligations within 3 years